You know what sucks? Getting into a car accident. You know what makes this situation worse? Not knowing what to do when you file a car insurance claim.

Despite our best efforts, even the safest drivers can be involved in a car accident. When this happens, knowing what to expect, what to do, and more importantly, what not to do will put your mind at ease. Check out these car insurance claim advice:

Table of Contents

ToggleFiling an insurance claim isn’t as stressful as you think. Below, we’ve listed the steps to take when filing your claim.

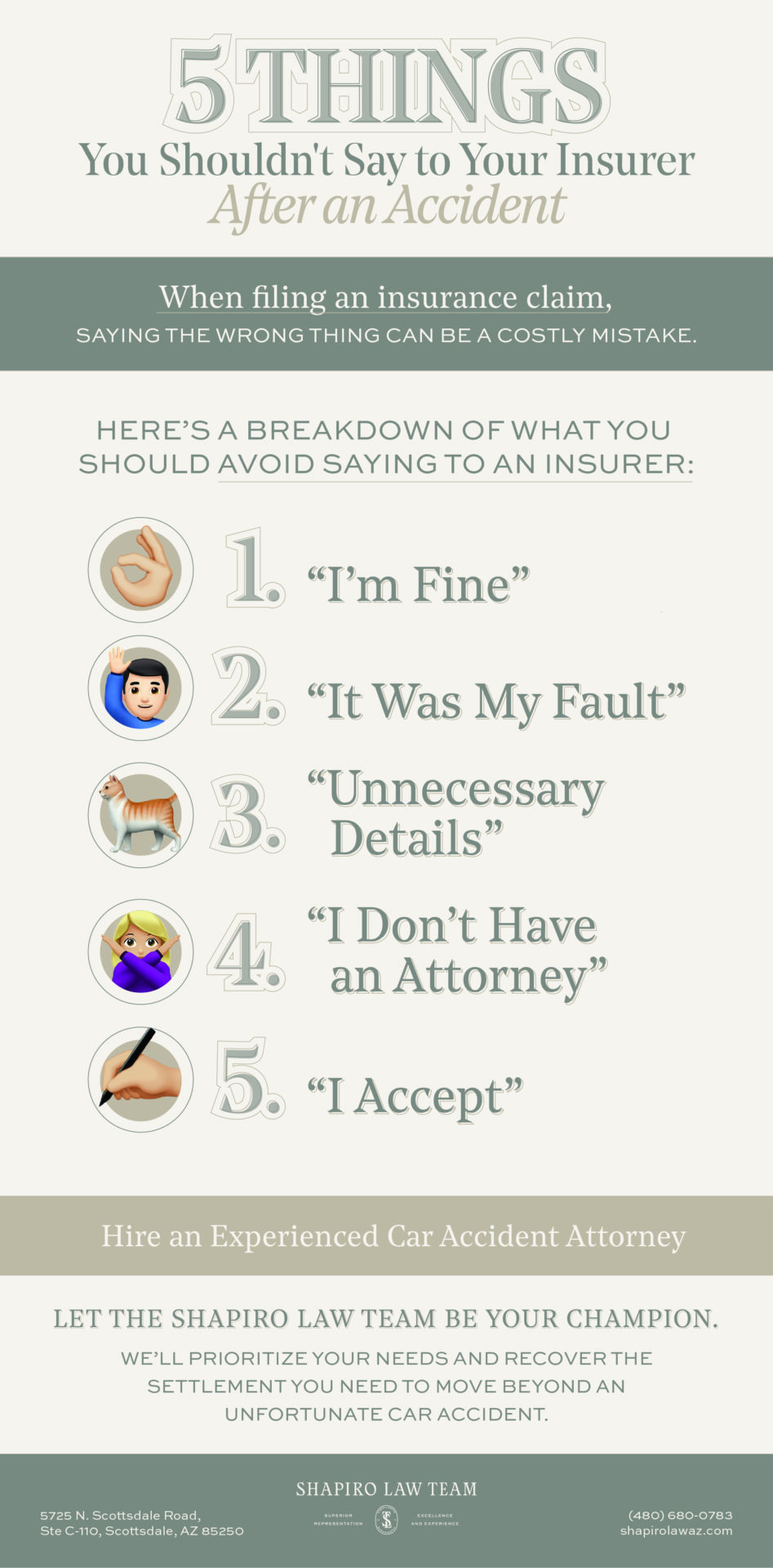

When filing an insurance claim, saying the wrong thing can be a costly mistake. Here’s a breakdown of car insurance claim advice and what you should avoid saying to an insurer:

Things Not to Say to Your Insurer After an Accident

Hiring professional representation is the best way to ensure your pain and suffering are taken seriously. Let the Shapiro Law Team be your champion. We’ll prioritize your needs and recover the settlement you need to move beyond an unfortunate car accident.

Call the Shapiro Law Team office at (480) 637-5692, or request a free consultation at our Phoenix or Scottsdale office today. Our skilled attorneys will ensure you avoid any and all personal injury claim mistakes.